Share this:

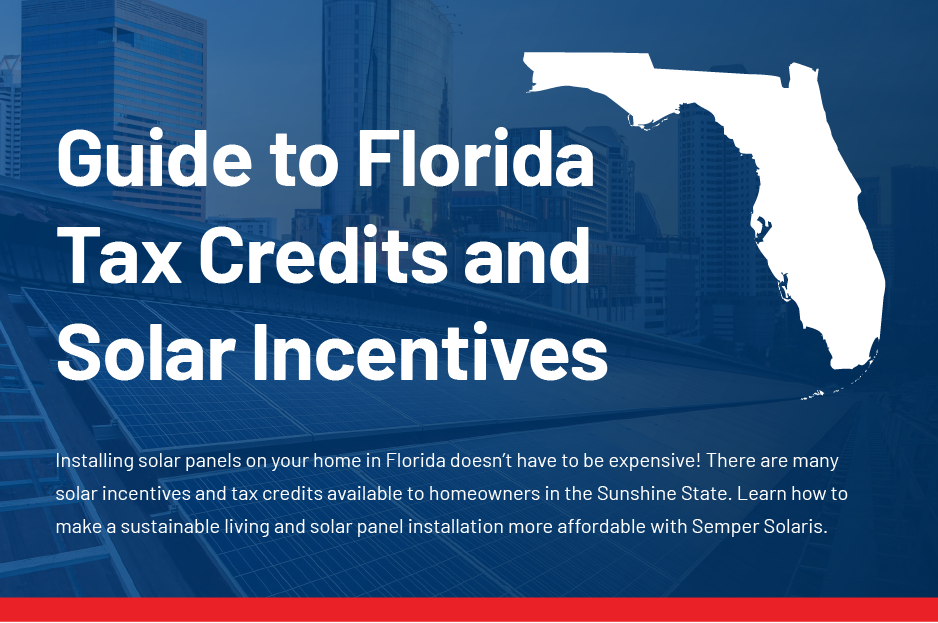

The guide to go solar in Florida

Claim the Federal Solar Investment Tax Credit

- The Florida Solar Energy Center says that “the Federal Government offers substantial incentives for consumers to take advantage of purchasing photovoltaic (PV) systems”

- The Federal Solar Investment Tax Credit is the biggest financial incentive available for solar panel systems in Florida

- Another term for it is the Residential Clean Energy Credit

- The tax credit is available to all homeowners and is offered by the federal government

- The credit is for 30% of the total cost of your solar panel system

- According to EcoWatch, “With just one tax credit, the average effective cost of solar panels can drop from $29,095 to a much more reasonable $20,367”

- Your credit gets applied to your income taxes for the year you have your system installed

- You can roll over any remaining credit if you don’t take the full credit that year

- Batteries that aren’t connected to your solar panels will also qualify for the tax credit if they have a capacity over 3 kWh

- The credits can roll over for up to five years after the panels are installed

- Claim the credit by filling out form 5695 from the IRS’s website

- Gather relevant information, like the solar panel installation company you used and what type of equipment you have

- File the form when you file your taxes for that year

Save Money With Net Metering

- Florida has a net metering policy that puts money back in your pocket

- When your solar panels produce more electricity than you consume, you’ll send energy back to the electrical grid

- The Florida Public Utilities Commission (PUC) states that your net metering payment needs to be equal to the full retail rate

- Every energy company in the state abides by the PUC’s rule

- These credits can get applied to future electrical bills

- Reduce or eliminate your monthly energy costs with net metering

- Make payments toward your solar panel system instead of paying your electric company

- You don’t have to do any extra work to qualify for net metering in Florida

- Contact your utility company to ensure your meter can support net metering

- Watch your electric bill to ensure you’re getting credits back

Explore Florida’s Battery and Solar Incentives

- Florida has sales and property solar tax exemptions

- You can claim sales tax exemptions for controls and pumps, solar panels, photovoltaic power

conditioning equipment, and solar batteries - You don’t have to do anything extra to claim the sales tax exemption

- Due to the property tax exemption in Florida, you won’t have to pay more taxes as your home’s value

increases due to your solar panels - A tax assessor will re-evaluate your property as part of the installation process

- They’ll exclude the value of your system from your property assessment

- You don’t have to take any extra steps to claim the property tax exemption for your solar panels

Apply for Florida Property-Assessed Clean Energy (PACE) Financing

- PACE solar financing is a loan program designed for solar panel systems offered by the state of Florida

- You only need to make a small down payment

- Take advantage of low-interest rates

- Your monthly payment will get tacked onto your tax bill

- PACE makes solar panel systems affordable for homeowners that might’ve previously been ineligible

- While it’s geared toward lower-income households, all Florida homeowners can apply

- You can apply for PACE funding directly on their website

- Homeowners will need to be current on their mortgage and property tax payments

- You also can’t have involuntary liens or notices of default to qualify for PACE funding

Check Out Local Solar Incentives

- Florida utility companies offer their own incentives for homeowners to take advantage of

- Boynton Beach residents and business owners can get up to $1,500 in solar rebates

- People living in Jacksonville can receive around $2,000 in solar energy incentives

- Dunedin homeowners can apply for a solar grant for no more than $2,500

- Solar panel owners in Orlando can qualify for up to $2,000 for installing a solar battery

- The City of Lauderhill offers low-interest loans for photovoltaic systems

- Apply for a no-down-payment and low-interest loan for your solar panels in Tallahassee

- Lakeland Electric customers can get up to a $1,000 rebate for installing a solar panel batter

Which Tax Credits for Solar Panels Are Best for Florida Homeowners?

- The federal solar tax credit is the best program to apply for to maximize your tax deductions

- It can reduce the average cost of solar panels by up to 30%

- Applying for the federal tax credit for solar panels takes very little time and effort

- Don’t forget that this credit isn’t a rebate – you won’t receive a check for the amount you’re owed

- Net metering is another big perk of exploring renewable energy in Florida

- Act on net metering immediately so you don’t miss out on potential savings in the future if the policy changes

- Local rebates can make your energy conversation methods worth it

- Cash-back incentives offered by cities and utility companies will put money back in your pocket

- Save yourself money by exploring what your city can offer you

FAQS

- Are there any Florida tax credits planned for solar panel systems in the future?

Right now, there are no current plans for new tax deductions for solar panel owners in the state of Florida. You’ll want to act quickly on installing solar panels on your home as some of the current policies, like net metering, could change in the future.